banking and finance

In the ever-evolving landscape of banking and finance, traditional models are continuously being reshaped by technological advancements and shifting economic paradigms. This sector, which serves as the backbone of modern economies, is pivotal in facilitating transactions, managing assets, and providing financial services to individuals and businesses alike. As we delve into the intricacies of banking and finance, it becomes evident that understanding the latest trends, regulatory changes, and innovative practices is essential for navigating this complex and dynamic environment. From fintech disruptions to the globalization of financial markets, the industry's transformation is both challenging and exciting.

Understanding the Basics of Banking and Finance

Banking and finance are integral parts of the modern economy, facilitating the flow of money, credit, and financial services. Understanding the fundamental concepts of banking and finance is crucial for individuals and businesses alike. This section will delve into the basics, providing a comprehensive overview of the key elements and principles.

What is Banking?

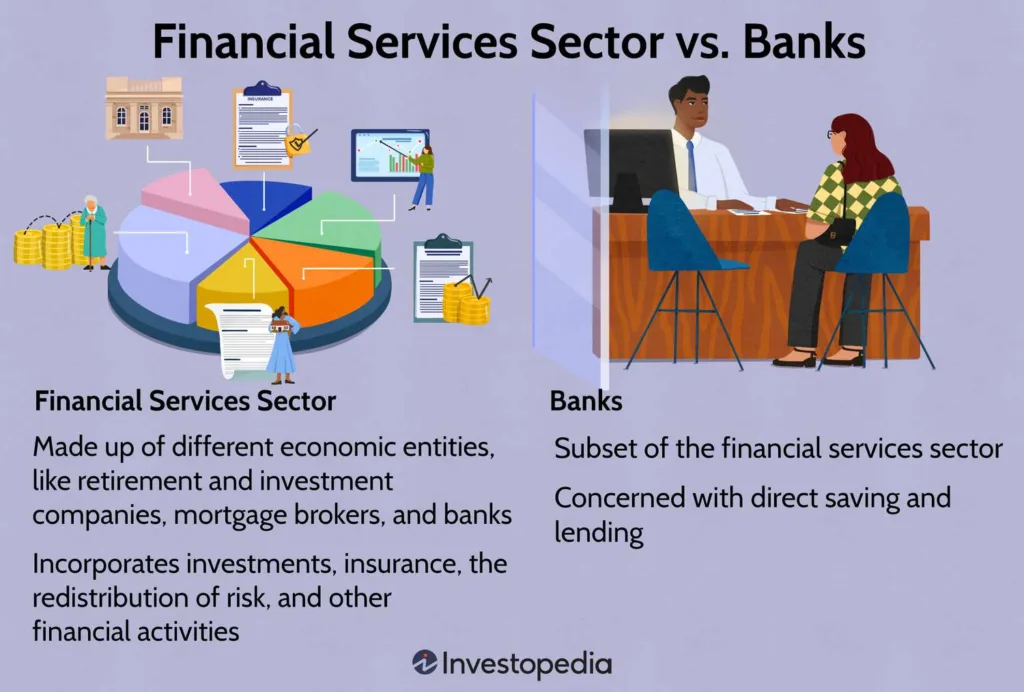

Banking refers to the activities and services provided by financial institutions, such as banks, credit unions, and savings and loans. These institutions accept deposits, offer loans, and provide various financial services to individuals and businesses. Banks play a pivotal role in the economy by facilitating transactions, managing savings, and extending credit.

The Role of Banks in the Economy

Banks serve multiple functions in the economy. They act as intermediaries between savers and borrowers, channeling funds from those with excess capital to those in need of credit. Banks also provide a safe place for individuals and businesses to store their money, offer various types of loans, and manage financial transactions. Additionally, banks contribute to economic stability by maintaining liquidity and ensuring the smooth functioning of financial markets.

Types of Financial Services Offered by Banks

Banks offer a wide range of financial services to meet the diverse needs of their customers. These services include:

- Deposit Accounts: Checking, savings, and money market accounts.

- Loans and Credit: Personal loans, mortgages, auto loans, and business loans.

- Investment Services: Mutual funds, retirement accounts, and wealth management.

- Payment Services: Credit and debit cards, online banking, and mobile payments.

- Financial Advice: Personal and business financial planning, tax advice, and investment consulting.

The Importance of Financial Literacy

Financial literacy is essential for making informed decisions about personal and business finances. It involves understanding basic financial concepts, managing money effectively, and making wise investment choices. Financially literate individuals are better equipped to navigate the complexities of banking and finance, avoid debt, and achieve their financial goals.

Regulatory Framework for Banks

Banks operate within a stringent regulatory framework to ensure the safety and soundness of the financial system. Regulatory bodies such as the Federal Reserve, the Securities and Exchange Commission (SEC), and the Financial Conduct Authority (FCA) oversee banks to protect consumers, maintain market integrity, and prevent financial crises. Key regulations include capital requirements, risk management standards, and consumer protection laws.

| Regulatory Body | Key Responsibilities |

|---|---|

| Federal Reserve | Monetary policy, bank supervision, and financial stability |

| Securities and Exchange Commission (SEC) | Regulation of securities markets and protection of investors |

| Financial Conduct Authority (FCA) | Regulation of financial services firms and protection of consumers |

| Consumer Financial Protection Bureau (CFPB) | Consumer protection in financial products and services |

| Office of the Comptroller of the Currency (OCC) | Supervision of national banks and federal savings associations |

Exploring Advanced Topics in Banking and Finance

Beyond the basics, banking and finance encompass a wide array of advanced topics that delve into the intricacies of financial markets, risk management, and global economic trends. This section will explore some of these advanced topics, providing insights into the complexities and challenges of the financial world.

Financial Markets and Instruments

Financial markets are platforms where financial instruments are bought and sold. These instruments include stocks, bonds, derivatives, and currencies. Understanding the dynamics of financial markets is crucial for investors, traders, and financial professionals. Key concepts in financial markets include liquidity, volatility, and market efficiency.

Risk Management in Banking

Risk management is a critical aspect of banking operations, involving the identification, assessment, and mitigation of various types of risks. These risks include credit risk, market risk, operational risk, and liquidity risk. Effective risk management strategies help banks maintain stability and protect their assets.

Global Banking and Financial Systems

The global banking and financial systems are interconnected, with cross-border transactions and financial flows playing a significant role in the world economy. Understanding the global financial landscape, including international regulatory frameworks and the impact of global events on financial markets, is essential for banks and financial institutions.

Innovations in Fintech and Banking

The rise of fintech (financial technology) has revolutionized the banking and finance industry. Fintech innovations include mobile banking, digital wallets, blockchain technology, and automated investment platforms. These innovations have enhanced the efficiency, accessibility, and security of financial services, reshaping the way banks and consumers interact.

Ethical and Social Responsibility in Finance

Ethical considerations and social responsibility are increasingly important in the banking and finance industry. Banks and financial institutions are expected to operate with integrity, transparency, and accountability. This includes responsible lending practices, environmental sustainability, and community engagement. Ethical and socially responsible practices not only enhance the reputation of financial institutions but also contribute to a more equitable and sustainable financial system.

What is banking and finance?

What is Banking and Finance?

Banking and finance are two interconnected but distinct fields that play a crucial role in the global economy. Banking involves the management of financial transactions and the provision of financial services, such as deposits, loans, and credit. Finance, on the other hand, encompasses a broader range of activities, including the management of assets, investments, and financial risks. Together, banking and finance form the backbone of the financial system, facilitating the flow of capital, managing risks, and enabling economic growth.

Key Functions of Banks

Banks perform several critical functions in the financial system. These include:

- Accepting Deposits: Banks accept deposits from individuals and businesses, providing a safe place to store money.

- Extending Loans: Banks lend money to individuals and businesses, helping to finance various activities and projects.

- Providing Credit: Banks offer various forms of credit, such as credit cards and lines of credit, to facilitate consumer and business spending.

- Managing Payments: Banks handle a wide range of payment transactions, including checks, wire transfers, and electronic payments.

- Offering Financial Services: Banks provide additional services such as wealth management, investment advice, and insurance.

Types of Financial Institutions

There are several types of financial institutions that operate within the banking and finance sector:

- Commercial Banks: These are traditional banks that offer a wide range of services, including deposits, loans, and payment services.

- Investment Banks: Specialized banks that focus on underwriting, issuing, and selling securities, as well as providing financial advice to corporations.

- Credit Unions: Non-profit financial cooperatives that provide banking services to their members, often with more favorable terms.

- Central Banks: Government-controlled institutions that manage a country's monetary policy and regulate the supply of money.

- Specialized Banks: Banks that focus on specific sectors, such as agricultural banks or savings and loan associations.

Core Concepts in Finance

Finance involves several core concepts that are essential for understanding the field:

- Risk Management: The process of identifying, assessing, and mitigating financial risks.

- Investment Strategies: Techniques used to allocate assets and make investment decisions to achieve financial goals.

- Financial Planning: The process of creating a comprehensive plan to manage an individual's or organization's financial resources.

- Corporate Finance: The area of finance that deals with the financial decisions and strategies of businesses, including capital structure and investment decisions.

- Portfolio Management: The management of a collection of investments to meet specific financial goals and objectives.

Regulatory Framework in Banking and Finance

The banking and finance sector is heavily regulated to ensure stability, protect consumers, and prevent financial crimes. Key aspects of the regulatory framework include:

- Capital Requirements: Rules that dictate the minimum amount of capital banks must hold to protect against potential losses.

- Consumer Protection: Regulations that safeguard consumers from unfair practices and ensure transparency in financial transactions.

- Anti-Money Laundering (AML): Laws and regulations designed to prevent the use of the financial system for the purpose of money laundering.

- Prudential Supervision: Oversight by regulatory bodies to ensure that financial institutions operate safely and soundly.

- Financial Reporting: Requirements for financial institutions to disclose accurate and timely information to regulators and the public.

What does a banking and finance degree do?

A banking and finance degree equips students with a comprehensive understanding of financial systems, banking operations, and the broader economic landscape. This degree program typically covers a wide range of topics, including financial markets, investment strategies, risk management, and regulatory frameworks. Graduates with a banking and finance degree are well-prepared for careers in various sectors, such as commercial banking, investment banking, financial planning, and corporate finance. The degree provides a solid foundation in both theoretical and practical aspects of finance, enabling students to analyze financial data, make informed decisions, and develop strategic financial plans.

Key Skills Acquired in a Banking and Finance Degree

A banking and finance degree imparts a variety of essential skills that are highly valued in the financial industry. These skills include:

- Financial Analysis: The ability to interpret financial statements, assess company performance, and evaluate investment opportunities.

- Risk Management: Techniques for identifying, assessing, and mitigating financial risks in various business contexts.

- Investment Strategies: Knowledge of different investment vehicles and the ability to construct and manage investment portfolios.

- Economic Understanding: A strong grasp of macroeconomic and microeconomic principles and their impact on financial markets.

- Regulatory Compliance: Familiarity with financial regulations and the ability to ensure compliance with legal and ethical standards.

Career Opportunities with a Banking and Finance Degree

Graduates with a banking and finance degree have a wide array of career options available to them. Some of the most common career paths include:

- Commercial Banking: Roles such as loan officers, credit analysts, and branch managers, focusing on providing financial services to individuals and small businesses.

- Investment Banking: Positions like financial analysts, investment bankers, and portfolio managers, dealing with capital markets, mergers and acquisitions, and financial advisory services.

- Financial Planning: Jobs as financial planners, wealth managers, and financial advisors, helping clients manage their assets and achieve financial goals.

- Corporate Finance: Roles in treasury management, financial planning, and analysis, supporting companies in financial decision-making and strategic planning.

- Regulatory Compliance: Positions in compliance departments, ensuring that financial institutions adhere to regulatory requirements and ethical standards.

Specializations within a Banking and Finance Degree

Many banking and finance degree programs offer specializations that allow students to focus on specific areas of interest. Some common specializations include:

- Financial Engineering: Combining financial theory, mathematical modeling, and computer science to develop innovative financial instruments and strategies.

- Quantitative Finance: Focusing on the application of advanced mathematical and statistical methods to financial problems, such as risk management and algorithmic trading.

- International Finance: Examining global financial markets, exchange rates, and cross-border financial transactions, preparing students for careers in multinational corporations and international financial institutions.

- Financial Technology (FinTech): Exploring the intersection of finance and technology, including blockchain, cryptocurrencies, and digital payment systems.

- Behavioral Finance: Studying the psychological factors that influence financial decision-making, providing insights into investor behavior and market anomalies.

Curriculum and Coursework in a Banking and Finance Degree

The curriculum of a banking and finance degree is designed to provide a well-rounded education in financial principles and practices. Core courses typically include:

- Financial Accounting: Understanding the preparation and interpretation of financial statements and the principles of accounting.

- Corporate Finance: Analyzing capital structure, dividend policy, and other financial decisions that affect a company's value.

- Investments: Studying different types of investment vehicles and the techniques used to evaluate and manage investment portfolios.

- Financial Markets and Institutions: Exploring the structure and function of financial markets and the roles of various financial institutions.

- Financial Risk Management: Learning strategies to identify, measure, and manage financial risks, including credit risk, market risk, and operational risk.

Networking and Professional Development in a Banking and Finance Degree

Networking and professional development are crucial components of a banking and finance degree. Many programs offer opportunities for students to:

- Internships: Gain practical experience through internships at financial institutions, investment firms, and other organizations.

- Professional Associations: Join student chapters of professional organizations, such as the Financial Management Association or the CFA Institute, to connect with industry professionals.

- Guest Lectures and Seminars: Attend talks and workshops featuring experts in the field, providing insights into current trends and best practices.

- Case Studies and Projects: Engage in real-world case studies and projects that simulate financial scenarios and enhance problem-solving skills.

- Career Services: Access career counseling, resume workshops, and job placement services to prepare for the job market.

Is finance and banking a good major?

Pursuing a major in finance and banking can be a rewarding and lucrative choice for many students. The field offers a wide range of career opportunities, from investment banking and financial analysis to risk management and wealth management. The demand for finance and banking professionals remains strong, driven by the continuous need for financial expertise in various industries. Additionally, the skills acquired through a finance and banking degree, such as analytical thinking, quantitative analysis, and strategic planning, are highly transferable and valuable in many sectors.

1. Career Opportunities in Finance and Banking

The finance and banking industry offers a diverse array of career paths, each with its own unique set of responsibilities and opportunities. Some of the most common roles include:

- Financial Analyst: Analyze financial data, create financial models, and provide recommendations for investment strategies.

- Investment Banker: Assist companies in raising capital, manage mergers and acquisitions, and provide financial advisory services.

- Risk Manager: Identify and mitigate financial risks, develop risk management strategies, and ensure compliance with regulations.

- Financial Advisor: Provide financial advice to individuals and businesses, helping them plan for the future and make informed investment decisions.

- Treasury Manager: Manage an organization's financial resources, including cash flow, investments, and debt management.

2. Salary and Earning Potential in Finance and Banking

One of the primary attractions of a finance and banking major is the potential for high earnings. According to the Bureau of Labor Statistics, professionals in this field often command competitive salaries, especially as they gain experience and move up the career ladder. For example:

- Financial Analysts earn a median annual salary of around $81,590.

- Investment Bankers can earn significantly more, with salaries often exceeding $100,000, especially in senior positions.

- Risk Managers have a median annual salary of approximately $77,580, with the potential for higher earnings in specialized roles.

- Financial Advisors earn a median annual salary of around $89,160, with the potential for additional income through commissions.

- Treasury Managers can earn salaries in the range of $95,000 to $150,000, depending on the size and complexity of the organization.

3. Skills Developed in a Finance and Banking Degree

A finance and banking degree equips students with a robust set of skills that are highly valued in the job market. These skills include:

- Quantitative Analysis: The ability to analyze and interpret complex financial data using mathematical and statistical methods.

- Financial Modeling: Developing and using financial models to forecast financial performance and make informed decisions.

- Strategic Planning: Formulating long-term financial strategies to achieve organizational goals.

- Communication: Effectively communicating financial information and recommendations to stakeholders, including clients, colleagues, and executives.

- Ethical Decision-Making: Understanding and applying ethical principles in financial decision-making, which is crucial in maintaining trust and integrity in the industry.

4. Industry Growth and Demand

The finance and banking industry is expected to continue growing, driven by factors such as technological advancements, globalization, and the increasing complexity of financial systems. This growth is creating new opportunities for professionals with specialized skills. Some key areas of growth include:

- FinTech: The integration of technology into financial services, creating new products and services such as mobile banking, online lending, and digital wallets.

- Sustainable Finance: The focus on environmentally and socially responsible investments, which is becoming increasingly important to investors and consumers.

- Regulatory Compliance: The need for professionals who can navigate and ensure compliance with increasingly complex financial regulations.

- Quantitative Finance: The use of advanced mathematical and computational techniques to analyze financial markets and develop trading strategies.

- Private Equity and Venture Capital: The growth of private equity firms and venture capital investors, which requires expertise in deal-making and portfolio management.

5. Challenges and Considerations

While a finance and banking major can lead to rewarding careers, it is not without its challenges. Students and professionals should be prepared for:

- High Work Pressure: The finance and banking industry is known for its fast-paced and high-pressure environment, which can be demanding and stressful.

- Long Hours: Many roles in finance and banking, particularly in investment banking and trading, require long working hours, especially during peak periods.

- Continuous Learning: The field is constantly evolving, and professionals must stay up-to-date with the latest trends, regulations, and technologies.

- Competition: The industry is highly competitive, and securing a job often requires exceptional academic performance, relevant internships, and networking.

- Ethical and Legal Responsibilities: Professionals must adhere to strict ethical and legal standards, which can be challenging in a complex and sometimes opaque industry.

What is the role of banking finance?

The role of banking finance is multifaceted and essential to the functioning of a modern economy. Banks serve as intermediaries between savers and borrowers, facilitating the flow of capital and credit. They provide a secure and accessible means for individuals and businesses to store and manage their money. Additionally, banks offer a wide range of financial products and services, including loans, credit cards, and investment opportunities. These services are crucial for personal financial management and for the growth and stability of businesses and the economy as a whole. Banks also play a critical role in the payment system, ensuring that transactions are processed efficiently and securely. By maintaining and managing the money supply, banks contribute to the overall financial stability and economic development.

The Role of Banks in Facilitating Credit and Loans

Banks play a pivotal role in facilitating credit and loans to individuals and businesses. They assess the creditworthiness of borrowers and provide loans at competitive interest rates. This function is crucial for several reasons:

- Capital Access: Loans enable businesses to invest in new projects, expand operations, and innovate, which can drive economic growth.

- Consumer Spending: Personal loans and credit cards allow consumers to make large purchases, such as homes and cars, which can stimulate demand in the economy.

- Risk Management: Banks use sophisticated risk assessment models to minimize the likelihood of default, ensuring the stability of the financial system.

Banking Services for Personal Financial Management

Banks offer a variety of services to help individuals manage their personal finances effectively. These services include:

- Checking and Savings Accounts: These accounts provide a safe and accessible way to store and manage money, with features like online banking and mobile apps.

- Investment Products: Banks offer a range of investment options, such as certificates of deposit (CDs), mutual funds, and retirement accounts, to help individuals grow their wealth.

- Insurance Services: Many banks provide insurance products, including life insurance, health insurance, and property insurance, to protect against financial risks.

The Role of Banks in the Payment System

Banks are integral to the payment system, ensuring that transactions are processed efficiently and securely. Key aspects of this role include:

- Electronic Payments: Banks facilitate electronic transfers, including direct deposits, wire transfers, and online payments, which are essential for modern commerce.

- Check Clearing: Banks process and clear checks, ensuring that funds are transferred accurately and promptly between accounts.

- Card Services: Banks issue and manage debit and credit cards, providing a convenient and secure method for making purchases and withdrawing cash.

The Importance of Banks in Economic Stability

Banks contribute significantly to economic stability by managing the money supply and providing financial services that support economic growth. Important contributions include:

- Monetary Policy Implementation: Banks work with central banks to implement monetary policy, which helps control inflation and stabilize the economy.

- Liquidity Provision: Banks maintain liquidity by holding a portion of their deposits in reserve, ensuring that they can meet the withdrawal needs of depositors.

- Financial Advice and Education: Banks offer financial advice and education to individuals and businesses, helping them make informed financial decisions.

Banks as Financial Intermediaries

Banks act as financial intermediaries, bridging the gap between savers and borrowers. This intermediation role is vital for several reasons:

- Efficient Capital Allocation: Banks channel savings into productive investments, ensuring that resources are used effectively.

- Risk Diversification: By pooling deposits and spreading risk across multiple loans, banks reduce the financial risk for individual savers and borrowers.

- Financial Innovation: Banks continually develop new financial products and services to meet the evolving needs of their customers, fostering financial inclusion and innovation.

Questions and Answers

What are the key factors to consider when choosing a bank for personal accounts?

When choosing a bank for personal accounts, several key factors should be considered to ensure that the bank meets your financial needs and offers the best possible service. Interest rates on savings accounts and fees for various services are critical aspects to compare. Additionally, the bank's online and mobile banking capabilities, including the user-friendliness of their apps and website, are increasingly important in today’s digital age. Customer service is another crucial element; look for banks with responsive and helpful support teams. Branch locations and ATM networks can also be significant, especially if you frequently need to visit physical branches or withdraw cash. Lastly, consider the bank's reputation and security measures to ensure your financial information is protected.

How can I improve my credit score effectively?

Improving your credit score is a vital step in achieving financial stability and accessing better loan terms. The first step is to obtain a free credit report from one of the major credit reporting agencies to identify any inaccuracies or issues. Paying bills on time is one of the most significant factors affecting your credit score, so set up automatic payments or reminders to avoid late payments. Reducing credit card balances and maintaining a low credit utilization ratio (ideally below 30%) can also boost your score. Avoid closing old credit accounts, as a longer credit history can positively impact your score. Diversifying your credit mix by having a combination of credit cards, loans, and other credit types can also be beneficial. Finally, disputing errors on your credit report and working with creditors to resolve any outstanding issues can further improve your credit score.

What are the benefits and risks of investing in the stock market?

Investing in the stock market can offer significant benefits and risks that investors should carefully consider. One of the primary advantages is the potential for higher returns compared to other investment options like savings accounts or bonds. Over the long term, stocks have historically provided strong returns, making them a valuable tool for wealth accumulation and retirement planning. Additionally, diversification can help reduce risk by spreading investments across various sectors and companies. However, the stock market is also subject to volatility, and prices can fluctuate significantly in the short term. This volatility can lead to losses, especially if investors are not well-prepared or do not have a long-term investment strategy. Market risks, such as economic downturns or company-specific events, can also impact stock performance. It is essential to conduct thorough research, consider your risk tolerance, and potentially seek advice from a financial advisor to navigate the stock market effectively.

What are the differences between a savings account and a checking account?

Understanding the differences between a savings account and a checking account is essential for effective financial management. A savings account is designed primarily for storing money and earning interest. These accounts typically offer higher interest rates than checking accounts and are ideal for saving for short-term goals or building an emergency fund. However, they may have limits on the number of withdrawals or transfers you can make each month. On the other hand, a checking account is designed for everyday transactions and provides easy access to your funds. These accounts typically come with a debit card and checkbook, allowing you to make purchases, pay bills, and withdraw cash. Checking accounts usually offer lower interest rates or no interest at all but provide greater liquidity and convenience. Both types of accounts serve different purposes, and many people find it beneficial to have both to manage their finances effectively.